The path cash takes has not changed in decades…

A customer pays you for a product or services. The cash gets put into a drawer, and eventually, one or two managers bring the money to the bank to be deposited. Sometimes this process takes days, and as time passes, rolling deposits become a vehicle for theft. Once the cash is deposited, the financial institution reconciles the deposit, and a few days later, the money finally makes it to your concentration account.

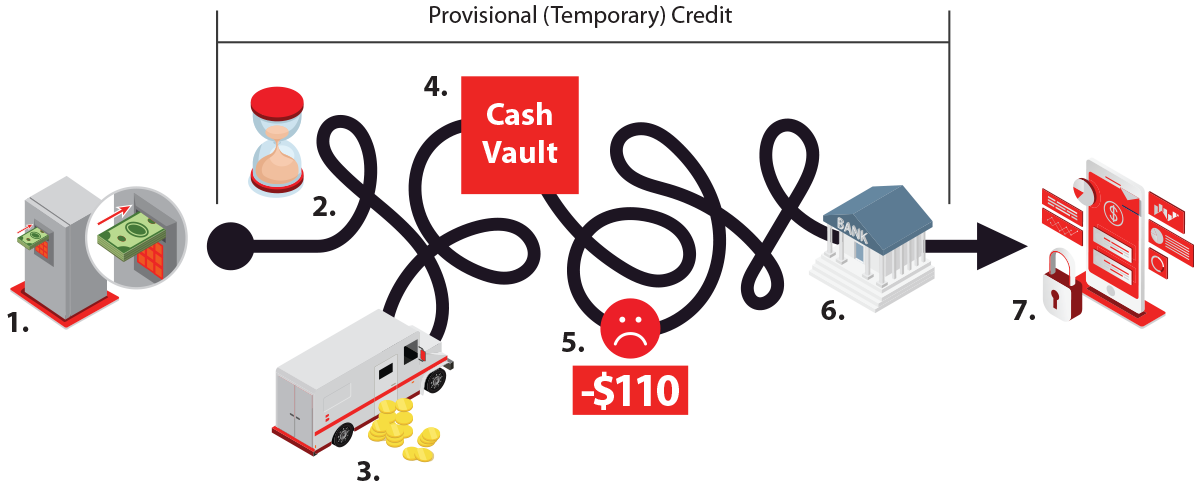

Provisional Credit was supposed to change everything, but includes challenges.

Provisional Credit was designed to remedy this, and it works… kind of.

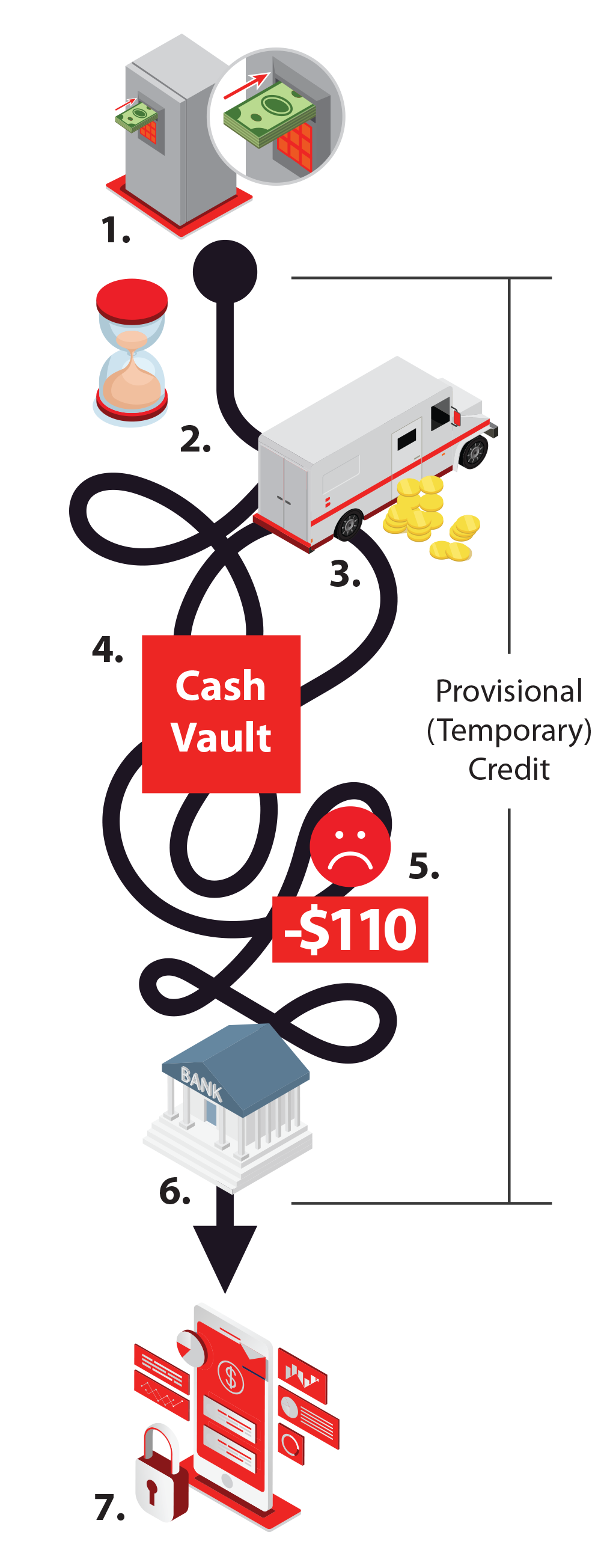

Provisional Credit has transformed industries but that doesn’t mean it’s the only or best option available. When cash is deposited into a retailer’s smart safe; information about this deposit is immediately transmitted to the bank, and provisional funds are credited to the retailer’s account while the cash remains secured in the safe. Eventually, a cash-in-transit service collects the money, delivering it to their cash vault.

Businesses integrate this model into their daily operations. Challenges can arise when the cash is finally reconciled days later and the deposit is either correct, over, or under. If the provisional credit does not align with the actual deposit, the financial institution must adjust the final amount. This can lead to mistakes, or worse, costly chargebacks or time consuming transaction disputes.

Now, there’s an alternative. CashSimple®.

The CashSimple® Path vs. Our Competitor’s Complex Path

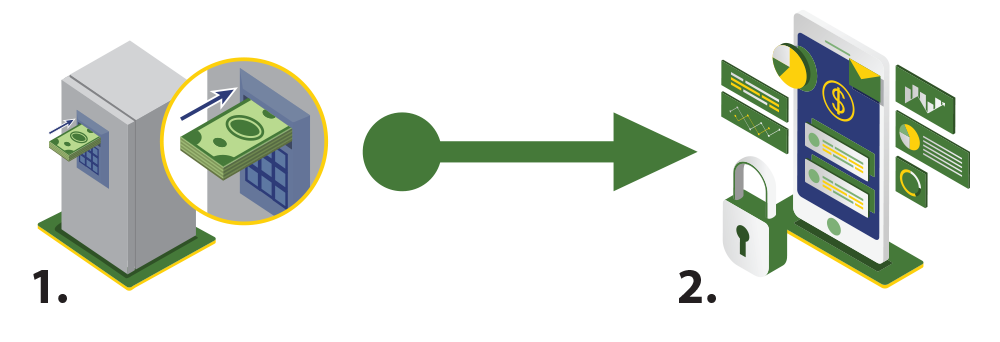

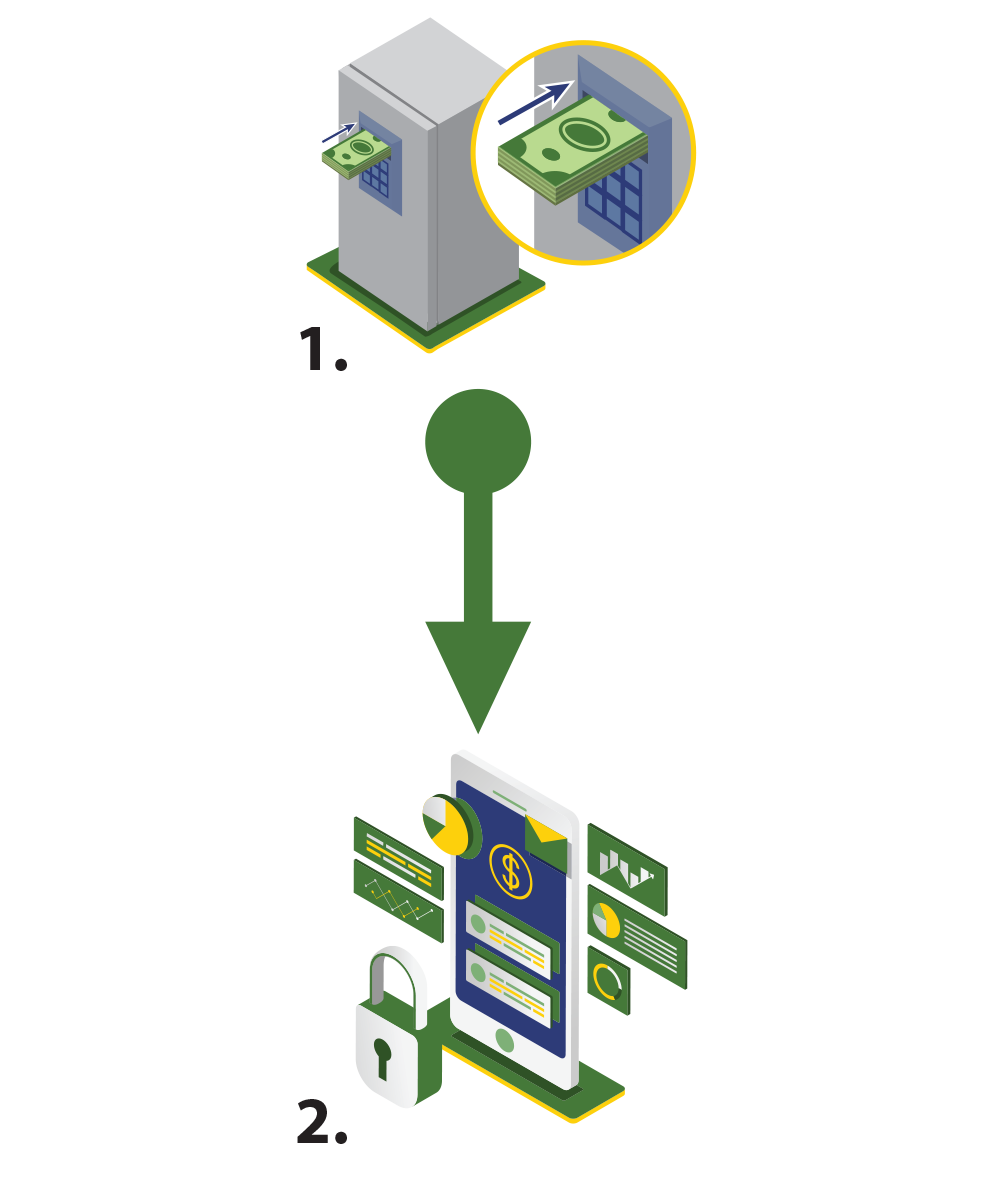

The CashSimple® Path

- Money enters smart safe. ICL buys your cash.

- The next day, a deposit for your cash arrives.

Our Competitor’s Complexity

- Money enters smart safe. Data is sent to transit vendor, then gets forwarded to your bank. Provisional credit kicks in.

- Your cash sits in the safe for days.

- Cash in transit service picks up your cash.

- Money is deposited in the transit service’s cash vault.

- The verification of funds is correct, over, or short.

- Bank gets notified of any discrepancies.

- Bank reviews and adjusts your final deposit.

CashSimple®: The Ultimate Alternative to Provisional Credit

CashSimple® does exactly what its name claims. It simplifies the way retailers manage their cash, transforming this decades-long process.

When you accept a customer’s cash for a product, you put that cash into ICL’s proprietary smart safe. As soon as the cash enters the safe, ICL buys your cash and frees you from any responsibility for that cash.

The next day, a deposit for that cash appears in your bank account, and from there, ICL manages all of the logistics associated with moving that cash. As long as the money makes it into your ICL smart safe, it makes it into your bank account.

It’s Simple Done Well.

Again, once you put that cash in ICL’s smart safe, all your responsibilities and liabilities end. CashSimple® simplifies the entire cash management process.

Once you deposit cash into ICL’s smart safe, your responsibilities end. CashSimple® is a straightforward alternative to Provisional Credit. It reduces the usual problems and uncertainties associated with traditional cash handling.

Partner with Integrated Cash Logistics and redirect your focus on what matters most– building sales, enhancing customer relationships, and expanding your business. Let CashSimple® handle the complexities of cash management.