Managing business finances can feel overwhelming, especially when bank statements don’t match your accounting records. This is where bank account reconciliation becomes an important part of your routine.

A bank reconciliation helps businesses keep track of financial transactions accurately while reducing errors, and maintaining a healthy cash flow. Understanding the bank reconciliation process and its importance is critical to keep business running smoothly.

- What Is Bank Reconciliation

- Why It’s Important

- How To Do a Bank Reconciliation

- Common Discrepancies

- Bank Reconciliation Example

- Bank Reconciliation FAQ

Integrated Cash Logistics’ unique approach to cash management puts security, efficiency, and accessibility at the forefront.

What Is A Bank Reconciliation?

What is the purpose of a bank reconciliation? Bank reconciliation in accounting is the process of comparing a company’s financial records with its bank statements to ensure accuracy. This includes checking that all transactions are recorded in both the company’s accounting cash books and bank reports. If any discrepancies are found, they can then be investigated and corrected to maintain financial stability.

By performing reconciliation banking tasks, businesses ensure they account for all cash transactions, detect potential errors, and prevent fraud. This process helps avoid financial inaccuracies that can quickly add up and cause challenges. This can improve cash forecasting which means smarter decision making.

Streamline your cash flow and cut operational inefficiencies with CashSimple®’s automated tracking and reporting.

Why Bank Reconciliation Is Important

Regularly reconciling bank statements is crucial for businesses to maintain financial accuracy. It ensures all payments and deposits are accounted for properly while highlighting errors or potential fraud risks. Once the bank reconciliation process is completed businesses are empowered to make strategic decisions that enable long-term growth and success.

Understanding Cash Flow

Understanding cash flow means having complete visibility into the money moving in and out of accounts. Bank reconciliation accounting ensures that recorded cash transactions align with actual funds in the bank. Businesses can then monitor available cash smoothly, avoid overdrafts, and plan expenses efficiently.

Finding Accounting Errors

Errors in record-keeping, like duplicate entries or missing transactions, can distort a company’s financial standing. By reconciling your bank accounts and cash ledgers, businesses catch and correct these mistakes before they create larger issues.

Detecting Fraud

Alongside capturing errors, bank reconciliation of bank statements highlights unauthorized transactions, altered checks, or unexpected withdrawals. This information quickly helps organizations identify fraudulent activity or prevent it from recurring which can have dangerous impacts on the businesses’ financial health.

Managing Risk

The steps in the reconciliation process that highlight errors or potential fraud all work together to reduce financial risk. Any issues or discrepancies can be addressed quickly and smoothly which minimizes liabilities, maintains compliance, and strengthens overall financial security.

Growing Business Confidence in Decision-Making

All of these benefits of bank reconciliation provide a stable foundation for businesses to grow their organization and make sound financial decisions. Accurate financial records provide business owners and stakeholders with confidence in their cash flow. With a well-managed reconciliation process, decision makers have better budgeting, understanding of investments, and overall business growth opportunities.

Managing multiple vendors for cash transport is a hassle. Instead, let Integrated Cash Logistics handle it all with a single, secure solution.

When to Complete A Bank Reconciliation

How often you should reconcile a bank statement depends on your number of transactions and overall industry standards for your business. Businesses with frequent transactions, like retailers and restaurants, should reconcile statements daily or weekly. Other industries may only need to complete the process on a monthly basis. However, the more frequently you complete bank reconciliation statements, the more likely you are to prevent errors from accumulating. Financial reporting becomes more reliable and steady despite any business fluctuations.

How to Complete A Bank Reconciliation

To prepare for a bank reconciliation you will need a few key items including bank statements, internal accounting records or ledgers, and any invoices or records of pending transactions. Furthermore, using a solution like CashSimple® provides real-time reporting of business cash flow. This information provides an accurate understanding of funds in your preferred bank accounts to support accurate bank records.

Compare Bank Balances and Cash Balance Books

The first step in reconciling a bank statement balance is comparing the company’s recorded cash balance to the bank statement. Each bank transaction should be reviewed line by line to match the accounting ledger amount. A major factor in ensuring accuracy is cash application, as misapplied or delayed payments can cause errors that make it appear as though cash is missing. Errors found in the bank statement or ledger can be related to cash application and include outstanding checks, unrecorded bank service fees, and pending bank deposits.

Add Bank-Only Transactions to Book Balance

As you review each transaction, some may only appear in bank statements before they are recorded in business cash accounts. These types of transactions are commonly bank fees, overdraft fees, interest charges or interest income amounts. Company ledgers should be updated to reflect these transactions with the appropriate amounts added or subtracted to the cash statements of the bank or accounting ledger.

Add Book-Only Transactions to Bank Balance

Similarly, some payments like outstanding checks or deposits in transit are recorded in the company records but have yet to reach the bank. The process to update statements is the same here with a focus on business accounting ledgers. However, with the CashSimple® solution, safe deposits are purchased as soon as they enter Integrated Cash Logistics smart safes. Once this cash is purchased, it is deposited into the business bank account within 24 hours so there’s no need to wait for armored cash transport. This eliminates provisional credit while supporting updated and real-time reports of cash flow.

Compare the New Adjusted Balances

Once all adjustments are made, compare the adjusted bank balance and the cash book balance. The final adjusted cash balance of the bank statement and the accounting ledgers should be the same. If they match, the reconciliation is complete and can be noted as such. If there are still discrepancies, further investigation is needed to understand why funds are unaccounted for.

Record Reconciliation

The last step in reconciling a bank statement is documenting the reconciliation process. This ensures an accurate audit trail and helps maintain compliance. This can be done through a brief notation at the end of the cash accounting ledger with any discrepancies listed and their resolution. The more detailed option is to complete the bank reconciliation statement which highlights all ingoing and outgoing transactions.

Avoid unnecessary bank fees and optimize how your business manages deposits and withdrawals.

Common Discrepancies Between Book and Bank Statements

When reconciling bank statements, businesses often find differences between their internal financial records and the bank’s records. These differences can be from timing differences, unrecorded transactions, or human errors in bookkeeping.

Some discrepancies are minor and easily corrected, while others may indicate more significant accounting issues that require investigation. Below are some of the most common reasons why bank and book balances may not align.

- Bank Fees: Charges for account maintenance, overdrafts, or wire transfers are common bank fees that may not be noticed immediately to record in internal books.

- Interest Earned: Some accounts accrue interest, which can be missed by businesses until it appears on a banking statement.

- Uncleared Checks: An uncleared check is one that has been issued by a business and recorded in its books but has not yet been processed by the bank.

- Returned or NSF (Non-Sufficient Funds) Checks: These types of checks occur when a customer’s account doesn’t have the money required to cover a payment. The bank removes the deposit from the business’s account, creating a discrepancy if the business has already recorded the deposit in its books.

- Duplicate Transactions: More commonly within accounting ledgers, the same transaction may accidentally be recorded more than once due to simple human error. Invoice numbers, transaction dates, and other details can confirm which amounts are correct.

Bank Reconciliation Example

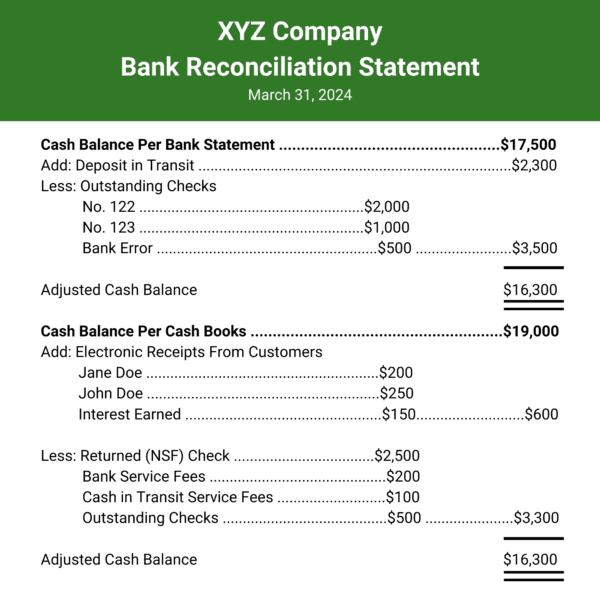

A practical example makes the bank reconciliation statement easier to understand. The table below demonstrates a reconciliation process where bank and book balances differ but are adjusted to match.

This reconciliation statement illustrates how deposits in transit, outstanding checks, and bank errors impact balances. Businesses should follow a similar process to align their financial records accurately.

Ready to simplify your cash handling process? Schedule a demo with Integrated Cash Logistics today.

Simplify Bank Reconciliation with CashSimple® Real-Time Cash Reporting

By regularly performing a bank reconciliation statement, businesses maintain financial accuracy, prevent fraud, and manage risk effectively. Manually reconciling accounts can be time-consuming and it’s easy to overlook details or make mistakes. CashSimple® offers real-time cash reporting, streamlining manual tracking to ensure accurate reconciliations.

Furthermore, eliminating provisional credit keeps cash moving into your bank account so records are up to date faster. With an automated cash handling solution like CashSimple® from Integrated Cash Logistics, businesses can streamline the bank reconciliation accounting process, reduce discrepancies, and gain real-time financial insights.

Bank Reconciliation FAQ

What if my reconciliation doesn’t match?

If your balances don’t align, review each transaction for missing entries, double-check adjustments, and ensure all deposits and withdrawals are recorded correctly. Verify transactions on the bank statements and internal cash accounts to find any errors.

How is cash reconciliation different from bank reconciliation?

Cash reconciliation focuses on internal cash flow like petty cash, safes, or cash registers against internal records. Alternatively, bank reconciliation compares a company’s recorded transactions to its bank statement to confirm that deposits, withdrawals, and other transactions align.

Who completes a bank reconciliation?

The bank reconciliation process can be completed by business owners, accountants, or other financial teams. They will reconcile bank statements, cash statements, and other important financial data to maintain holistic and accurate financial records.

How often should I reconcile my bank statements?

The frequency depends on business needs. Businesses with a high amount of cash transactions like retail businesses or restaurants should reconcile weekly or daily. Smaller businesses or boutiques, agencies or firms that don’t handle cash frequently, or independent contractors may only need to complete a bank reconciliation once a month.