Are you tired of surprise bank fees eating into your bottom line? You’re not alone — and a bank fee analysis can help. Business owners everywhere are looking for clear answers on how to cut banking costs.

Bank fees can quickly add up. If you’re not keeping a close eye, you could be overpaying for services you don’t even need. Regularly performing an analysis of service charges from your bank is the key to spotting hidden costs and minimizing them before they can make a real impact. In this step-by-step guide, we’ll break down how to review and analyze your fees, uncover opportunities for savings, and make smarter financial decisions for your business.

- What is it?

- Key Components

- Common Fees

- Steps of Bank Fee Analysis

- Understanding Your Results

- Opportunities for Cost Savings

Learn more about Integrated Cash Logistics Cash Management Solutions.

What is a Bank Fee Analysis?

A bank fee analysis is the process of reviewing and categorizing the various fees your bank charges for services like transactions, cash management, and account maintenance. Breaking down these charges helps businesses uncover hidden or excessive costs that would have gone unnoticed.

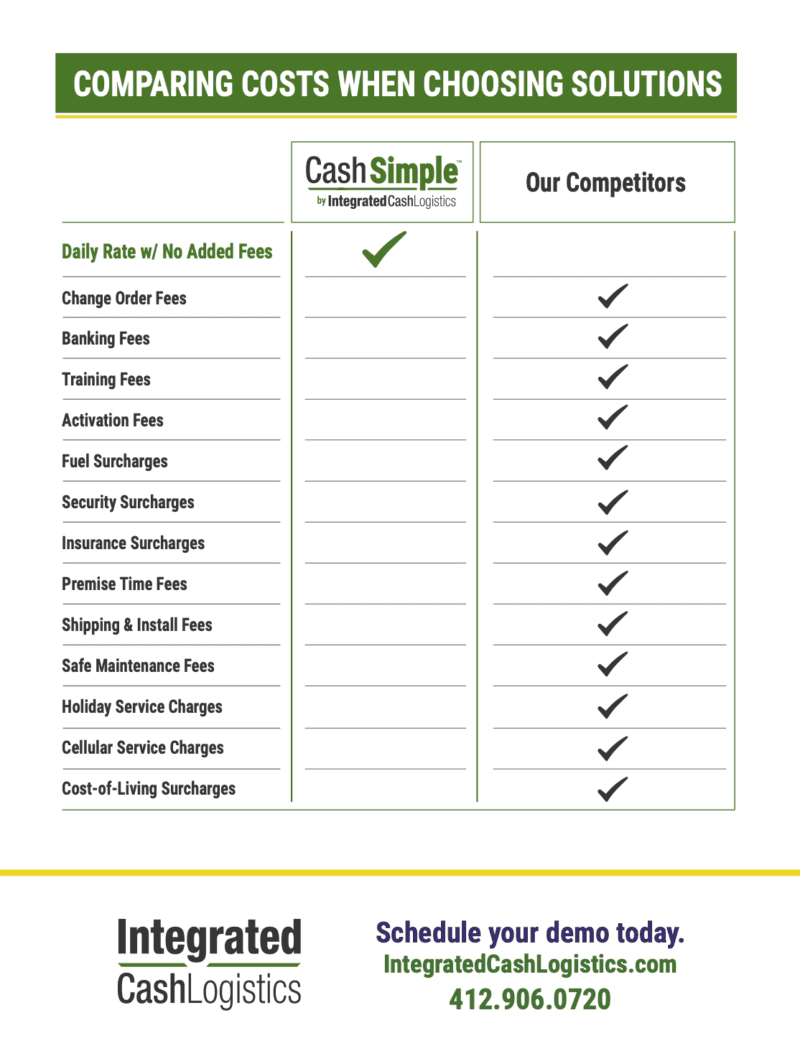

Furthermore, considering that most cash handling service companies have hidden fees for expenses you wouldn’t consider, bank fee analysis highlights where you might be paying more than necessary. It’s also an important component to understanding overall expenses that are crucial to determining your company’s profit margin.

Conducting a thorough analysis helps clarify where your money is going while providing opportunities to optimize banking operations. That way, you’re only paying for services that actually add value. Through this process, you identify potential savings and prevent overpayments, especially when factoring in account analysis charges or account analysis fees.

Key Components of a Bank Fee Analysis

Without this analysis, businesses risk paying for services they don’t need or use. If you really want to understand why banks charge fees, interpreting each type of charge is crucial. A successful bank fee analysis starts with understanding the key elements that affect your overall banking costs.

Let’s break down the steps in more depth to understand how proper bank fee management can keep banking costs in line and spot opportunities for savings.

- Fee Identification: Begin by identifying all fees your bank charges including transaction fees, cash handling, and account maintenance. This step helps you understand where your money is going.

- Categorizing Bank Fees: Then, once identified, what are the bank fees for? Figure this out by grouping fees into clear categories. This will give you a better understanding of which services contribute most to your overall costs.

- Analyzing Volume vs. Cost: Compare the volume of services you use with the fees charged. This helps determine if certain high-volume services are driving up your costs unnecessarily.

- Benchmarking Fees: Finally, compare your fees against industry standards to identify areas where you might be overpaying and where negotiations with your bank could help.

Schedule a demo to learn how ICL’s cash capture technology simplifies how you control cash.

Common Fees to Look for in a Bank Fee Analysis

When reviewing your bank statements, it’s important to understand what a bank service charge is and how it affects your overall costs. These are some of the most common bank charges that businesses should pay attention to during a fee analysis. Recognizing these fees can help pinpoint areas for savings, especially in the case of a franchise with multiple locations where fees can quickly add up.

- Transaction Fees: These are charged for processing payments, transfers, or withdrawals. They can add up quickly if your business handles a high volume of transactions.

- Monthly Maintenance Fees: A recurring fee for maintaining your account. Some banks waive this charge if you meet specific balance requirements.

- Reconciliation Fees: This fee occurs when the bank account statement and the business’s bookkeeping records do not match. The amount must be corrected in the organization’s accounts which can lead to money loss. However, with CashSimple®, which is not provisional credit solution, this liability is completely eliminated.

- Overdraft and NSF Fees: Fees incurred when your account balance is insufficient to cover a transaction. These can be costly and are often avoidable with better cash flow management.

- Treasury and Cash Management Fees: These fees apply to services related to managing cash flow, such as wire transfers or lockbox services.

Save on your bottom line by avoiding unexpected and hidden fees from other cash handling services.

Steps to Perform a Bank Fee Analysis

Once you have a clear understanding of the many banking fees you may have, you can begin the bank fee analysis process. Each step helps you gather, organize, and review data for actionable insights. Following this process allows you to identify where your money is going and uncover opportunities for cost savings that empower better business cash management.

1. Gather Fee Statements

Start by collecting your bank statements, contracts, and fee schedules. These are typically available through online banking or by requesting them from your bank. For a full picture, gather at least 6-12 months’ worth of data.

2. Analyze and Classify Fees

Once you’ve collected your data, sort the fees into categories like transaction fees, account maintenance, and cash management. You might be wondering, what is an account analysis? This organization helps reveal which services are driving your costs.

3. Review Bank Contracts and Agreements

Carefully review your bank contracts to make sure the fees you’re being charged match what was agreed upon. Watch for hidden fees or discrepancies that could be inflating your costs.

4. Compare Fees Across Multiple Banks

Compare your bank’s fees with those offered by other institutions or industry benchmarks. A thorough bank fees comparison will show if you’re overpaying for services that might be cheaper elsewhere.

5. Negotiate With Your Bank

Use the data from your analysis to negotiate better rates. With clear insights in hand, approach your bank and request lower fees or improved terms for the services you use most.

From retail to restaurants and banking, CashSimple® is the right solution for any industry.

Interpreting and Understanding Your Results

Understanding the results of your bank fee analysis is the foundation for determining how to improve cost savings. Once you have all the data, you can start interpreting the fees, identifying high-cost services, and spotting patterns that reveal where your money is going.

From there, you can decide on the best steps to optimize your banking expenses.

Analyze Volume vs. Cost

Assess whether the fees you’re paying align with the volume of services you use. For example, are you paying high fees for frequent wire transfers or cash management services that could be automated? If the costs seem disproportionate to the service volume, you may be overpaying. This analysis helps you determine if it’s time to reduce usage or renegotiate fees.

Identify High-Cost Services

Look for services that incur the highest fees, such as treasury management or frequent transactions. Are these services essential, or could you cut back? Identifying these high-cost services helps you determine whether you need them or if you can replace them with more efficient alternatives. For example, trusting ICL with your cash handling needs eliminates third-party vendor frustrations while ensuring your money gets to the bank faster.

Assess the Impact of Small, Recurring Fees

Small fees such as monthly maintenance or transaction charges might seem insignificant at first, but they add up over time. Regularly review these recurring fees to see if they are worth keeping. Eliminating or reducing unnecessary small fees can lead to substantial savings over the long term.

Use Benchmark Data

Compare your bank fees against industry benchmarks to see if you’re overpaying. Benchmark data helps you determine whether your fees are competitive or if they’re higher than what others in your industry are paying. This can give you leverage when negotiating better rates or switching to a different bank.

Determine Actionable Next Steps

Now that you’ve analyzed your fees, it’s time to act. Renegotiate your bank contracts, eliminate unnecessary services, or switch to a more affordable banking provider. Taking these steps based on your analysis means you’ll only pay what you need. Ultimately, this will lower your overall banking costs.

Discover how CashSimple® meets your unique needs to streamline operations and keep accounting ledgers accurate.

Identifying Opportunities for Cost Savings

Now it’s time to act. With insights from your bank fee analysis, you can take steps to cut costs and improve your banking efficiency. These practical strategies and smart adjustments help reduce fees and boost your bottom line.

Consolidate Services Across Accounts

Streamline your banking. Consolidating services across multiple accounts eliminates redundant charges and simplifies your processes. For example, combining cash management solutions or multiple transaction accounts into one can eliminate redundant charges. This approach simplifies banking while cutting unnecessary costs.

Renegotiate Bank Contracts

Negotiate for better rates. Armed with data from your analysis, use the insights to renegotiate your bank contracts – especially targeting high-cost services and frequent fees.

Present the bank with a clear proposal that outlines where you believe reductions can occur. If needed, have them explain bank charges. This can lead to better terms and lower fees.

Switch to Fee-Free or Low-Fee Services

Cut your fees. If your current bank charges high fees for essential services, consider switching to fee-free or low-fee alternatives. Research banks that offer competitive rates on the services you use most, such as transaction processing or cash management. This switch can result in significant savings.

Save on Your Bottom Line With Integrated Cash Logistics and Make the Most of Your Bank Fee Analysis

A thorough bank fee analysis isn’t just about uncovering hidden costs. It’s about making smart decisions that can improve your financial future. By understanding your fees and taking action, you’re already on the path to greater cost control and efficiency. But this is just one step in improving your overall cash management and cash handling business practices.

Integrated Cash Logistics offers tailored solutions that take your banking and cash management to the next level. ICL designs its services, from real-time reporting to expert support, to help businesses streamline their processes and cut unnecessary expenses. If you’re ready to optimize your banking strategy and reduce fees, ICL’s CashSimple® solution can make a real impact.

Curious to know more? Get in touch and explore how ICL can help you gain control over banking costs and other common cash handling expenses.