Managing cash across multiple locations, banking institutions, and vendors has long been a challenge for businesses that rely on cash. Slow deposits, high banking fees, and complex reconciliation processes create unnecessary financial risks and inefficiencies that drain time and resources.

Centralized cash management provides a more efficient solution for businesses that want to accelerate access to cash, simplify banking, and cut costs. By consolidating cash operations into a single system, you can gain real-time visibility, automate reconciliation, and have greater control over liquidity management and financial health.

What Is Centralized Cash Management?

A centralized cash management system consolidates cash flow into a single, integrated platform to eliminate the inefficiencies in managing multiple banking relationships, manual reconciliations, and cash transport dependencies.

Instead of relying on outdated, decentralized methods, businesses gain complete visibility into cash deposits, withdrawals, and overall liquidity across all locations. Centralizing cash management simplifies operational efficiency and overall cash flow management, reducing financial risk.

ICL’s CashSimple® eliminates cash deposit delays, reconciliation errors, and banking restrictions.

Who Should Use a Centralized Cash Management System?

Many businesses are moving away from traditional cash management because it’s slow, fragmented, and costly. Banking restrictions, provisional credit risks, and reliance on multiple vendors create bottlenecks that delay cash access and increase financial complexity. Centralization removes these challenges for faster deposits, lower costs, and better oversight.

The types of businesses that can benefit most from centralization include:

- Retailers, convenience stores, and restaurants that need fast deposits, automated reconciliation, and secure cash handling.

- Banks and financial institutions that want to simplify cash movement and offer clients greater banking flexibility.

- Franchise operations and multi-location businesses that require a single system to track and manage cash flow across all sites. Read our e-book on How Franchises Can Streamline Cash Management to learn more.

A centralized cash management system can dramatically eliminate inefficiencies and improve cash flow if your business handles large volumes of cash and operates multiple locations.

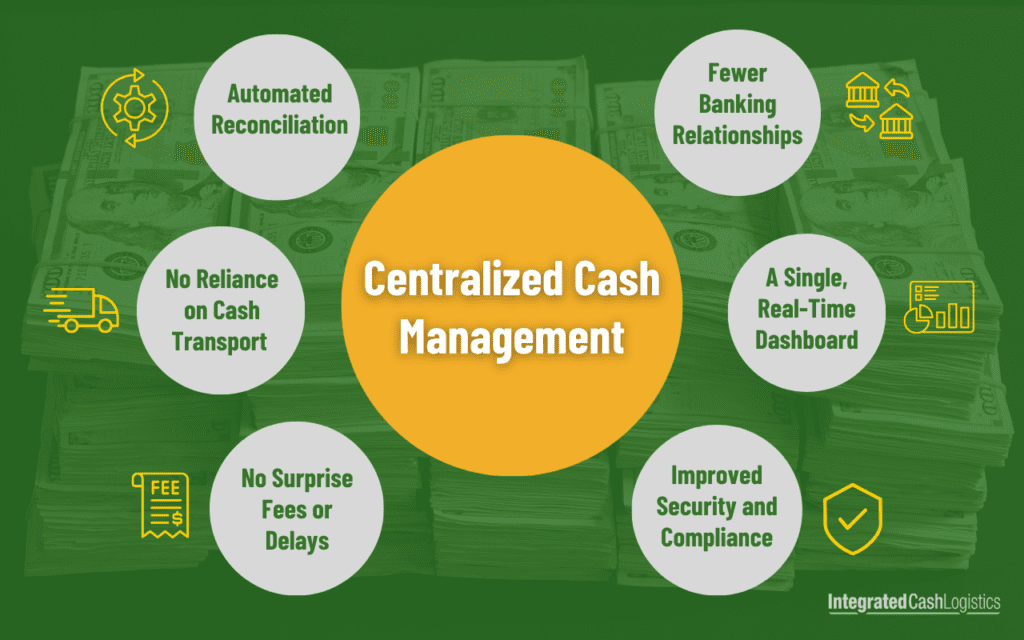

Top Five Advantages of Centralized Cash Management

A centralized cash management system improves efficiency by consolidating all cash-related activities into one system. Here are a few of the key benefits of centralized cash operations:

- Real-Time Cash Visibility and Control

- Faster Access to Cash

- Cost Savings and Reduced Banking Fees

- Enhanced Security and Reduced Cash Shrinkage

- More Banking Flexibility

1. Real-Time Cash Visibility and Control

The first step toward better cash management optimization is getting a clear picture of cash flow. However, one of the biggest issues with traditional cash management is the lack of real-time oversight. Businesses often operate with disjointed systems that delay financial reporting, leading to inaccurate cash forecasts and costly inefficiencies.

With centralized cash control, treasury teams gain a single, real-time dashboard to monitor cash deposits, withdrawals, and transactions across all locations. ICL’s configurable portal streamlines cash tracking, eliminates reconciliation errors, and enables faster, data-driven financial decisions.

2. No Cash Access Delays or Bank Restrictions

Traditional cash management systems rely on slow deposit schedules, provisional credit, and armored car pickups—creating delays that restrict access to working capital. Businesses often wait days or even weeks before seeing their funds reflected in their bank accounts.

ICL’s instant cash buyout model eliminates this delay. The moment your cash enters a smart safe, ICL purchases it and wires the funds to your bank the next day. No waiting, no provisional credit risks—just fast, seamless cash access.

3. Cost Savings and Reduced Banking Fees

Operating with multiple bank accounts, frequent deposits, and cash transport costs add up quickly. Traditional banking relationships introduce unnecessary fees, such as transaction charges, deposit fees, and reconciliation costs.

A centralized cash management system streamlines these processes, reducing costs across all locations. ICL’s all-inclusive pricing eliminates surprise banking fees and provisional credit charges—ensuring simple, transparent cost savings.

4. Enhanced Security and Reduced Cash Shrinkage

Handling large amounts of cash across multiple locations increases theft, fraud, and human error risks. Many businesses experience cash shrinkage due to internal mismanagement or security gaps in handling deposits.

With a centralized system, businesses gain automated reconciliation tools and smart safes that eliminate manual cash handling and reduce shrinkage. ICL’s solution shifts cash liability away from your business as soon as funds enter a smart safe, ensuring secure, fully accounted-for transactions.

Upgrade from outdated cash handling to a smarter, faster solution – with CashSimple®.

5. More Banking Flexibility – Bank Anywhere, No Restrictions

Many businesses struggle with banking restrictions based on cash transport services or financial institution policies. This creates unnecessary dependencies, making it difficult to move funds freely or consolidate accounts across multiple locations.

ICL’s centralized cash management solution removes these restrictions, allowing businesses to bank with any institution—regardless of location. Instead of being tied to a specific banking network, you choose where to deposit funds based on the best financial advantages.

This flexibility can be incredibly transformative for franchisors with hundreds (or thousands) of locations – and dozens of banking relationships to support them. For example, ICL’s centralized solution enabled a QSR chain with thousands of locations to reduce their banking relationships from 60 to just 15. Read more about it in our case study.

Common Challenges of Centralizing Cash Management

Despite the benefits, some businesses hesitate due to concerns about implementation, risk management, and operational complexity. However, you can easily overcome these challenges with the right cash management provider.

Complex Implementation and Integration

Many businesses fear that integrating a centralized cash management system will require major infrastructure changes or disrupt daily business operations. ICL eliminates this concern with a plug-and-play system that integrates seamlessly with your existing banking partners and financial systems.

With easy onboarding and automated data synchronization, you can immediately start tracking cash in real time—without operational disruptions. Plus, with ICL’s especially short initial term, you can experience the benefits of optimized cash management with minimal commitment—making the transition easier with lower risk.

Resistance to Change from Local Teams

Business managers and treasury teams often resist change due to concerns about losing control over cash handling. However, centralization enhances control by automating reconciliation, reducing manual errors, and improving visibility.

With ICL’s system, treasury teams gain full financial oversight, while local managers spend less time on manual cash tasks (and more time on providing excellent customer service).

Managing Cash Across Multiple Locations

For multi-location businesses, manually reconciling cash creates delays, errors, and additional banking costs. ICL’s cloud-based software allows you to monitor and reconcile real-time cash transactions across all locations.

Sound too good to be true? We hear that all the time. Book a demo with us to see it for yourself.

Centralize Cash Management with ICL’s CashSimple® Solution

If your business still relies on traditional, fragmented cash management, you’re likely losing time, money, and visibility into your financial operations. Managing multiple banking relationships, waiting for deposits to clear, and juggling reconciliation errors add unnecessary complexity to your treasury function.

Centralized cash operations eliminate these inefficiencies, giving you:

- Real-time cash visibility across all locations

- Faster access to funds without banking delays

- Lower costs by removing banking fees and reconciliation expenses

- Enhanced security to reduce shrinkage and cash-handling risks

- Banking flexibility so you can manage deposits on your terms

Integrated Cash Logistics (ICL) is an industry leader in centralized cash management.

With ICL’s CashSimple®, you can take full control of your cash flow while eliminating unnecessary delays, restrictions, and risks. Whether you operate a retail chain, restaurant group, or multi-location franchise, ICL’s solution provides the speed, security, and efficiency your business needs to thrive.

Book a demo today. Find out how ICL can transform your cash management.

It’s time to move beyond outdated cash-handling processes and upgrade to a simpler, smarter, and more secure way to manage your money.