You can improve your business operations and your bottom line by taking control of your cash management. If you are new to intentional cash management, you may be asking yourself, “What is cash management, and how can I do it well?”

Safely and efficiently managing cash flow is crucial for any restaurant, convenience store, retail store, or bank. Not sure where to begin? Use this guide to learn concrete strategies for cash management that can help you meet your business goals.

- What Is Cash Management?

- What Are Cash Management Services?

- Why Is Cash Management Important For Businesses?

- Cash Management Responsibilities

- Cash Management Examples

- Cash Management Strategies

Simplify your cash operations and boost efficiency with CashSimple®. See how it can transform your business today!

What Is Cash Management?

Cash management is the monitoring and handling of a business’s cash flow or movement, including collecting, managing, and investing the company’s money. It covers managing cash inflows and outflows throughout daily operations and in the long run.

There is a misconception that cash management is the same as treasury management, but it’s important to understand how each is unique. Cash management differs from treasury management in scope and specific tasks. Cash management mainly deals with daily cash flow and liquidity, while treasury management handles wider financial strategies like risk management and investment planning.

What Are Cash Management Services?

Cash management services take away the burdens and responsibilities related to cash control and movement. Common cash management duties that are included in a cash management service include cash pickup and real-time account monitoring.

When done well, cash management integrates with your online bank account, making it easy to monitor cash flow and access money anytime you need it. Instead of using old-school flow statements, many cash management services keep track of your cash flow for you, saving time and minimizing the possibility of human errors.

Why Is Cash Management Important For Businesses?

Cash management is an essential part of operations and decision-making for any business.

Effective cash management can help you:

- Safely store and deposit cash

- Increase your business’s liquidity, which means more investment and growth opportunities

- Ensure operations run smoothly by paying all your bills on time

- Manage payroll to ensure accuracy

- Build a cash reserve to cover unexpected costs and avoid cash shortages

- Increase profitability and long-term financial stability

While it’s possible to achieve these benefits with your own cash management strategy, you will get results much more easily and quickly with a cash management service. Cash management services also support banks by simplifying the cash deposit and change order processes and reducing the risks of fraud and theft. This improves client relationships and retention. As businesses make more money and grow, banks make more money, too. Everyone wins!

Discover how smarter cash management systems can save your business time and money.

Cash Management Responsibilities

The responsibilities of cash management in a business often fall on the owner, CFO, treasurer, or managers, depending on the size of the organization and business structure. Key responsibilities include forecasting financial needs, budgeting accordingly, overseeing transactions, and collecting and safeguarding funds.

To keep the business running smoothly and ensure profitability, all cash management must be handled accurately, securely, and promptly. Your exact cash management duties will differ based on the type of business you run, whether it’s a bank, restaurant, retail store, or convenience store.

Cash Management Examples

You are likely performing cash management duties daily, even if you didn’t realize it before reading this. When you schedule payments to a vendor, send an invoice to a client, or transfer money between bank accounts, you are managing your cash flow. If you run a franchise, improving your cash management procedures can help your business thrive. Consider automating tasks like payments to suppliers and change orders.

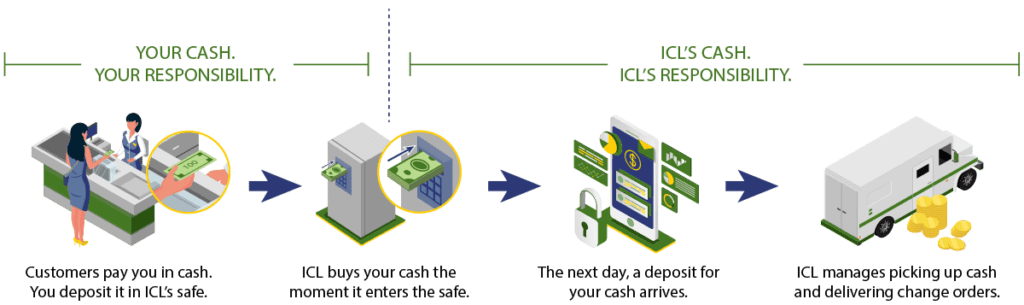

Many cash-heavy businesses, like restaurants and some convenience stores, use smart safes to keep money secure and count it automatically. This helps reduce discrepancies at the end of the day. With CashSimple®, stores and restaurants can access funds deposited into the safe without needing to run to the bank during a busy shift. This is because Integrated Cash Logistics buys your cash when it’s deposited in the safe, making it our responsibility.

Ready to take control of your cash handling? Schedule a demo to see how our cash management solution works in real time.

Cash Management Strategies

Many businesses fail due to poor cash management. Having clearly defined cash management strategies can help you avoid many of the pitfalls that other businesses encounter.

The more you can streamline and automate cash management processes, the more efficient your business will run and the less overhead costs you will incur. Consider setting cash flow targets and regularly analyzing spending to identify areas where money is being wasted.

These strategies can help any company, but make sure to adapt them to your unique business needs. What works for a multinational corporation may not work well for a small or medium-sized business.

See How ICL’s CashSimple® Cash Management Solution Works

Don’t let your cash management strategy get derailed by outdated technologies like provisional credit and manual flow statements. ICL’s CashSimple® is a modern solution to improve cash security and control without provisional credit by immediately buying your cash from you as soon as you deposit it into the safe. CashSimple® automates key processes like change orders and reduces operational risk for cash-heavy businesses.

Schedule a free demo to explore why CashSimple® is the right cash management solution for your business.